DSA Correspondent

Middle East on the Brink: Israel Strikes, Iran Retaliates

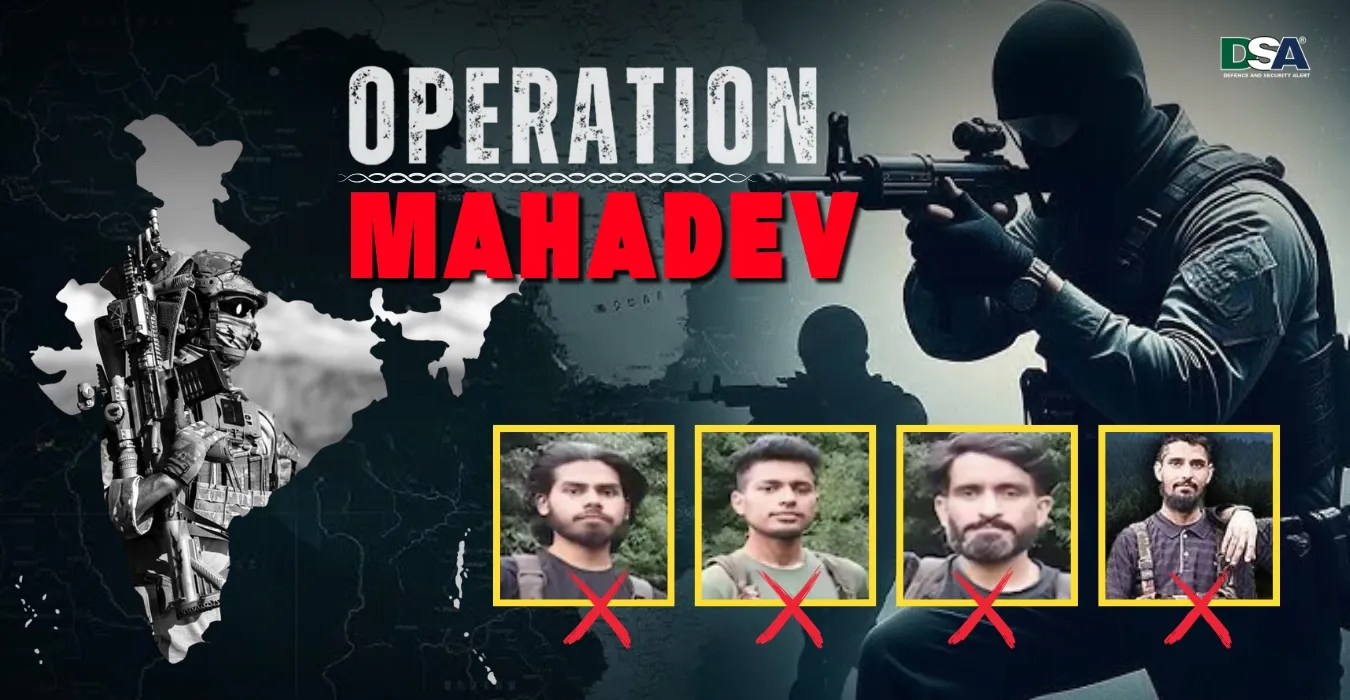

The recent outbreak of direct hostilities between Israel and Iran has set off alarm bells across global capitals. In a major military escalation, the Israel Defense Forces (IDF) launched Operation Rising Lion on Friday—striking Iranian nuclear and military sites across multiple provinces. These included uranium enrichment facilities in Natanz, Fordo, and Isfahan, as well as airfields in Hamadan and Tabriz.

According to Israeli officials, the strikes aimed to prevent Iran from acquiring a nuclear weapon, with Prime Minister Netanyahu declaring the action as “preemptive and necessary.” In contrast, Iran labelled the strikes a “blatant act of aggression” and swiftly retaliated by firing over 100 drones and ballistic missiles at Israeli targets, including Tel Aviv. Some missiles bypassed Israeli air defences, resulting in civilian casualties and infrastructure damage.

This confrontation comes just days before the sixth round of nuclear talks between the United States and Iran in Oman—casting serious doubt on the prospects for diplomatic resolution.

Key Global Impacts of the Conflict

Geopolitical Polarisation

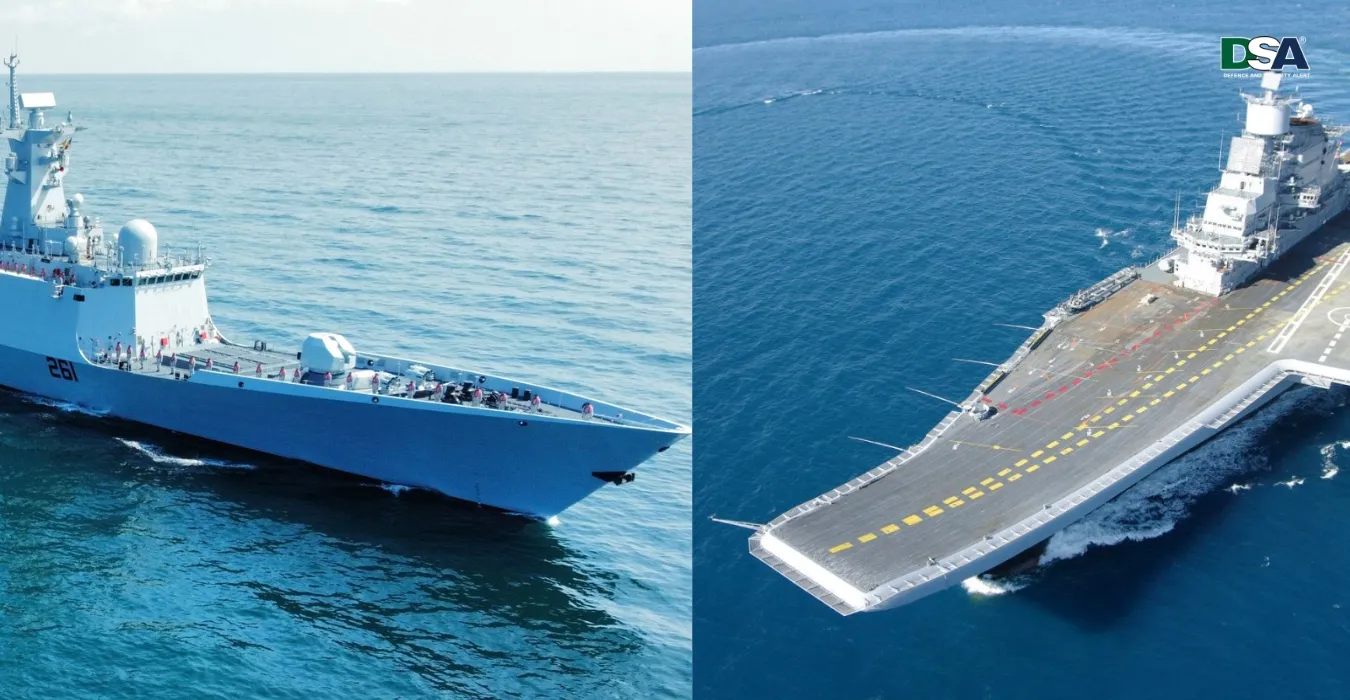

The escalation deepens divides between global powers. The United States and Israel are likely to face increased friction with Iran and its regional allies, including non-state actors such as Hezbollah in Lebanon and Houthis in Yemen. China and Russia, who maintain varying degrees of engagement with Iran, may further complicate global diplomatic efforts.

Oil Prices Surge

With the Strait of Hormuz—through which nearly **30% of the world’s seaborne oil passes—**now under threat, oil markets have reacted sharply. Brent crude surged above $95/barrel, raising concerns over global energy inflation. Import-reliant nations in Asia, Africa, and Europe face renewed pressure on energy security.

Aviation and Logistics Disruption

Airspace closures in Israel, Iran, and surrounding areas have forced global airlines to reroute flights, increasing travel times and operational costs. Meanwhile, shipping through the Suez Canal and Red Sea could face increased risks if the conflict spills into adjacent maritime zones.

Supply Chain Uncertainty

The region’s instability may once again strain global supply chains, especially as commercial traffic adjusts routes to avoid conflict zones. This could have downstream effects on freight costs, manufacturing timelines, and commodity prices worldwide. This would directly affect common people worldwide.

Market Volatility

Investors are responding with caution. Stock markets in Asia and Europe dipped, while demand rose for traditional safe-haven assets like gold and U.S. Treasury bonds. The rising risk premium on Middle East-linked investments could impact global financial flows in the weeks ahead.

A Tipping Point in Global Affairs

This is not just a regional war—it’s a confrontation with global consequences. As the Middle East once again becomes a flashpoint for international conflict, the world finds itself on uncertain ground. Whether or not major powers intervene directly, the diplomatic, economic, and security reverberations will be felt far beyond West Asia.

The coming days will test the resilience of global diplomacy, international institutions, and markets. A wider regional war remains a looming threat—one that the international community can ill afford.

-min.webp)

-min.webp)

.webp)

9958382999

9958382999